XRP Price Prediction: 2025, 2030, 2035, 2040 Forecasts

#XRP

- Technical Indicators: XRP is trading above its 20-day MA with bullish MACD and Bollinger Band signals.

- Market Sentiment: Positive news around SEC resolution, corporate adoption, and trading hub developments.

- Price Forecasts: Long-term growth potential driven by adoption and ecosystem expansion.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

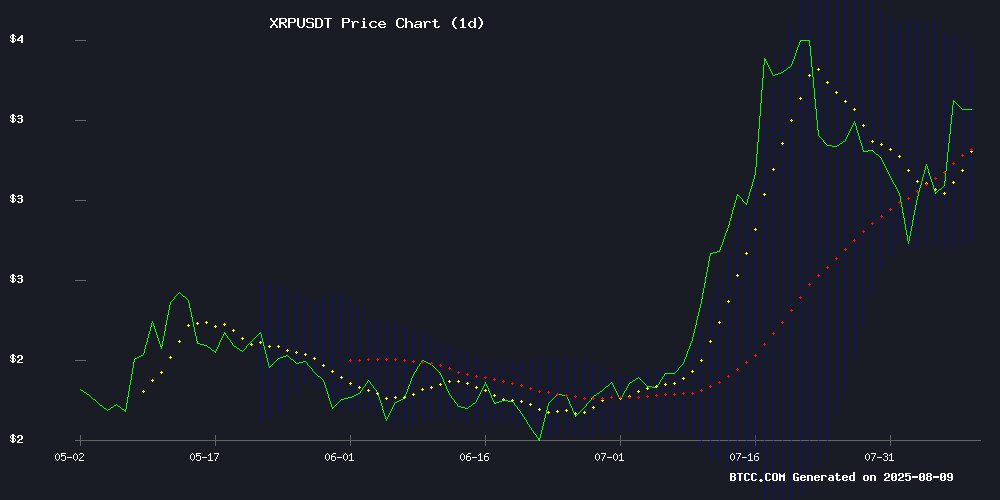

According to BTCC financial analyst Sophia, XRP is currently trading at $3.2788, above its 20-day moving average of $3.1467, indicating a bullish trend. The MACD shows positive momentum with a reading of 0.1325 above the signal line (0.0736). Bollinger Bands suggest volatility, with the upper band at $3.5212 and the lower band at $2.7723. These technical indicators point to potential upward movement in the NEAR term.

XRP Market Sentiment: Strong Bullish Momentum

BTCC financial analyst Sophia notes that recent news highlights significant bullish sentiment for XRP. Key developments include South Korea emerging as a trading hub, the SEC lawsuit resolution, and corporate adoption of XRP treasuries. The MVRV ratio signals bullish momentum, and Gemini's $1,000 giveaway further fuels optimism. Analysts are forecasting a final bullish wave using Elliott Wave Theory, with XRP already surging to $3.27 post-SEC settlement.

Factors Influencing XRP’s Price

South Korea Emerges as XRP Trading Hub Following SEC Case Resolution

South Korea has surged to the forefront of XRP trading activity, with Upbit recording $1.09 billion in 24-hour volume—outpacing global leader Binance's $966.80 million. The rally follows the conclusion of the SEC's protracted legal battle over XRP's regulatory status, triggering what market observers describe as 'FOMO heating up' among traders.

Upbit's dominance highlights South Korea's outsized influence in the current market cycle. The exchange's XRP volumes exceeded those of Coinbase ($450.30M), Bybit ($399.74M), and Kraken ($222.11M), with OKX, Crypto.com, and Bitstamp rounding out the top tier. This concentrated trading activity suggests regional investors are leading the charge in reevaluating XRP's market position post-regulation clarity.

XRP Price Poised for Upsurge as MVRV Ratio Signals Bullish Momentum

XRP's market value to realized value (MVRV) ratio has flashed its third golden cross since November 2024, historically a precursor to significant price rallies. Analyst Ali Martinez highlights this pattern as XRP attempts to reclaim its yearly peak of $3.66 following the resolution of Ripple's legal battle with the SEC.

The MVRV golden cross occurs when short-term valuation metrics surpass long-term averages, typically during periods of accelerating buying pressure. Previous instances in November 2024 coincided with 60%+ price surges, fueled initially by macroeconomic catalysts like the U.S. election outcome.

Market technicians view the current setup as particularly compelling given XRP's extended consolidation below $1.00. The token's realized cap now shows accumulation by long-term holders, while spot volumes across major exchanges suggest renewed institutional interest.

Gemini Celebrates XRP's Legal Clarity with $1,000 Giveaway, Teases Upcoming Announcement

Gemini, a leading U.S. cryptocurrency exchange, is capitalizing on XRP's resurgence by giving away 305 tokens—worth approximately $1,000—to a single follower. The promotional move coincides with XRP's rebound to $3.36 following the resolution of Ripple's protracted legal battle with the SEC. Participants merely needed to engage with Gemini's social media post to qualify.

The exchange's celebration of "the future of finance" comes as XRP demonstrates renewed market vigor. Legal certainty has injected optimism into the asset, with Gemini strategically aligning its brand with this momentum. Winners must hold active Gemini accounts to claim prizes, reinforcing user acquisition efforts.

In a cryptic follow-up, Gemini hinted at a significant development arriving within weeks. While details remain undisclosed, the timing suggests potential XRP-related product expansions or partnerships. Such moves could further legitimize the token amid evolving regulatory landscapes.

Analyst Forecasts XRP's Final Bullish Wave with Elliott Wave Theory

Crypto analyst Mr. Xoom predicts XRP is entering Wave 5 of its bullish cycle, the final phase in Elliott Wave Theory. The asset previously surged 575% during Wave 3, climbing from $0.50 to $3.39, before correcting to $1.60 in April.

Since the April low, XRP has rebounded 129%, peaking at $3.66 in mid-July—a level unseen in nearly eight years. While the price has since cooled, Wave 5 typically delivers significant gains, suggesting potential upside ahead.

SEC Waiver Fuels Optimism for XRP as Legal Hurdles Ease

Ripple's protracted legal battle with the U.S. Securities and Exchange Commission has taken a favorable turn. The regulator granted a critical waiver allowing the blockchain firm to bypass fundraising restrictions tied to its ongoing case—a move market participants interpret as a de facto victory for XRP.

The waiver coincides with both parties dropping appeals in the landmark lawsuit. It effectively removes barriers to private capital raises, a development attorney John Deaton's Crypto Law highlighted as pivotal. "This is the regulatory equivalent of a get-out-of-jail-free card," remarked one analyst, citing xAI's Grok chatbot interpretation of the SEC's softened stance.

Market observers note the timing aligns with broader crypto policy shifts, including 2025's stablecoin legislation. XRP holders now anticipate reduced selling pressure from institutional holders—a potential catalyst for price appreciation absent regulatory overhang.

Ripple Lawsuit Settlement Sparks Corporate XRP Treasury Adoption

The resolution of Ripple's legal battle with the SEC has triggered a wave of institutional interest in XRP. Corporate treasuries are now actively accumulating the cryptocurrency, mirroring Ethereum's earlier trajectory as a balance sheet asset.

Quantum Biopharma and Worksport Ltd have publicly disclosed XRP holdings in recent SEC filings, marking a strategic pivot toward digital assets. Hyperscale Data Inc. plans a $10 million XRP allocation, signaling deepening institutional confidence.

Pro-XRP attorney Bill Morgan notes at least four companies have revealed holdings since the lawsuit's conclusion. This trend reflects growing recognition of cryptocurrencies as legitimate treasury assets, with XRP emerging as a preferred choice following regulatory clarity.

XRP Surges to $3.27 Following SEC Settlement as Ripplecoin Mining Launches New Yield Product

XRP rallied over 5% to $3.27 after Ripple Labs and the SEC formally concluded their four-year legal battle through mutual appeal withdrawals. The resolution removes a key regulatory overhang that had weighed on the digital asset since 2020.

Ripple CEO Brad Garlinghouse framed the settlement as paving the way for XRP's adoption as a global payment standard. Market analysts anticipate further upside toward the $3.97 resistance level as institutional confidence rebuilds.

Capitalizing on renewed optimism, Ripplecoin Mining unveiled cloud-based XRP contracts converting holdings into daily payouts. The passive income product arrives as regulatory clarity sparks what industry observers describe as a "second wave" of institutional interest in the asset.

SEC Concludes Ripple Lawsuit, XRP Army Celebrates Legal Victory

The U.S. Securities and Exchange Commission has formally ended its legal battle against Ripple Labs, dismissing all remaining appeals. The August 8 resolution leaves intact a $125 million fine against Ripple while affirming XRP's non-security status—a decision hailed as industry-wide validation for cryptocurrency projects facing regulatory scrutiny.

Ripple's supporter base, the self-styled XRP Army, views the outcome as historic vindication. Their steadfast advocacy throughout the 4.5-year lawsuit transformed what began as a crisis—the SEC's 2020 allegation of $1.3 billion in unregistered securities sales—into a rallying point for decentralized finance proponents.

Market observers note the precedent strengthens legal arguments for other altcoins facing similar challenges. The resolution removes a major overhang for XRP, which saw significant volatility during the proceedings, though ripple effects across exchange listings and institutional adoption remain to be seen.

VivoPower to Acquire $100 Million in Ripple Shares for XRP Exposure

VivoPower International PLC, a Nasdaq-listed company, is making a strategic move to bolster its XRP-focused digital asset treasury. The firm plans to acquire $100 million worth of privately held Ripple Labs shares, pending approval from Ripple's executive management. This transaction positions VivoPower as the first publicly listed U.S. company to offer investors dual exposure to Ripple's equity and XRP tokens.

The share purchase implies an XRP price of $0.47—a significant discount to current market rates. VivoPower's strategy combines direct Ripple share acquisitions with XRP token purchases, aiming to optimize yield while reducing acquisition costs. For every $10 million invested, the company expects to enhance its treasury's XRP holdings efficiently.

Ripple's diversified business units add substantive value to VivoPower's investment thesis. The deal underscores growing institutional interest in crypto-native assets, with XRP at the forefront of strategic treasury allocations.

Trump Ends 'Debanking' Policy as SEC Closes Ripple Case

President Donald Trump's executive order prohibiting banks from cutting off customers over political or religious views marks a significant shift in financial policy. The move eliminates the controversial 'reputation risk' rule that critics argue targeted crypto firms. Bank of America CEO Brian Moynihan cautiously endorsed the decision, signaling potential relief for the industry.

Ripple's protracted legal battle with the SEC reached a pivotal conclusion as regulators removed the 'Bad Actor' designation. While the $125 million fine and institutional sales restrictions remain, the blockchain company regains critical fundraising capabilities under Regulation D. 'This is the end,' declared Ripple's chief legal officer Stuart Alderoty, capping a lawsuit that shaped crypto regulation for nearly five years.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical and market sentiment analysis, BTCC financial analyst Sophia provides the following XRP price predictions:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $4.50 - $5.00 | Post-SEC settlement momentum, corporate adoption |

| 2030 | $10.00 - $15.00 | Mainstream adoption, Ripple's ecosystem growth |

| 2035 | $25.00 - $40.00 | Global payment integration, institutional demand |

| 2040 | $50.00 - $100.00 | Full-scale decentralized finance (DeFi) integration |

HTML